Figures released by Financial Fraud Action UK (FFA UK) show a significant rise in the number of people who have been targeted by phone scammers over the last year.

The research, carried out on behalf of FFA UK by ICM, suggests that 58% of people have received suspect calls, a rise from 41% from research last year.

The increase in scam calls is reflected in new figures, also published today, which show a threefold rise in the amount of money lost to phone scammers. Over the last year, at least £23.9m of losses can be attributed to Vishing – up from £7m in the previous year.

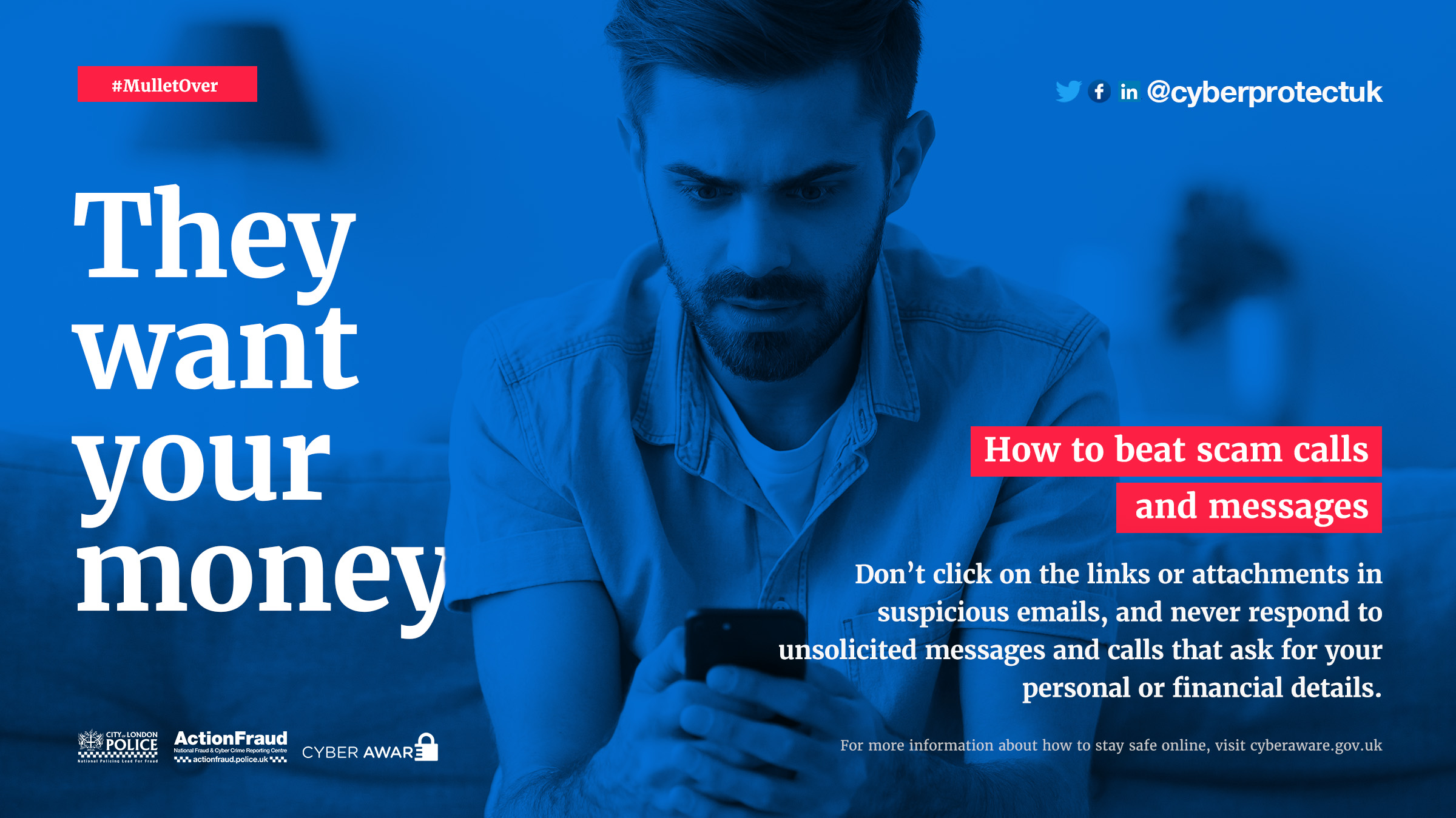

These ‘cold call’ scams typically involve fraudsters deceiving victims into believing they are speaking to a police officer, a member of bank staff, or a representative of another trusted organisation, such as a computer company in order to steal money.

Joint declaration

In response, a rare ‘Joint Declaration of the UK Banks’ supported by Police launched today, has brought together banks, building societies and card companies, as well as Chief Police Officers, to clarify the warning signs of a phone scam.

DCI Perry Stokes, Head of the Dedicated Cheque and Plastic Crime Unit (DCPCU) – a specialist policing unit funded by the banking industry and a signatory to the Joint Declaration – said:

“Always be on your guard if you receive a cold call and are asked for personal or financial information, or to hand over your card or cash to someone. The bank or the police will never tell you to take such actions, so if you’re asked it can only be a criminal attack. Wait five minutes and call your bank, preferably from a different telephone, if you have even the slightest doubt”.

Read more on the Financial Fraud Action UK website.

Please note: Action Fraud is not responsible for the content on external websites.

To report a fraud and receive a police crime reference number, call Action Fraud on 0300 123 2040 or use our online fraud reporting tool.

| Attachment | Size |

|---|---|

| Joint Declaration of the UK Banks.pdf | 1.73 MB |