What it is

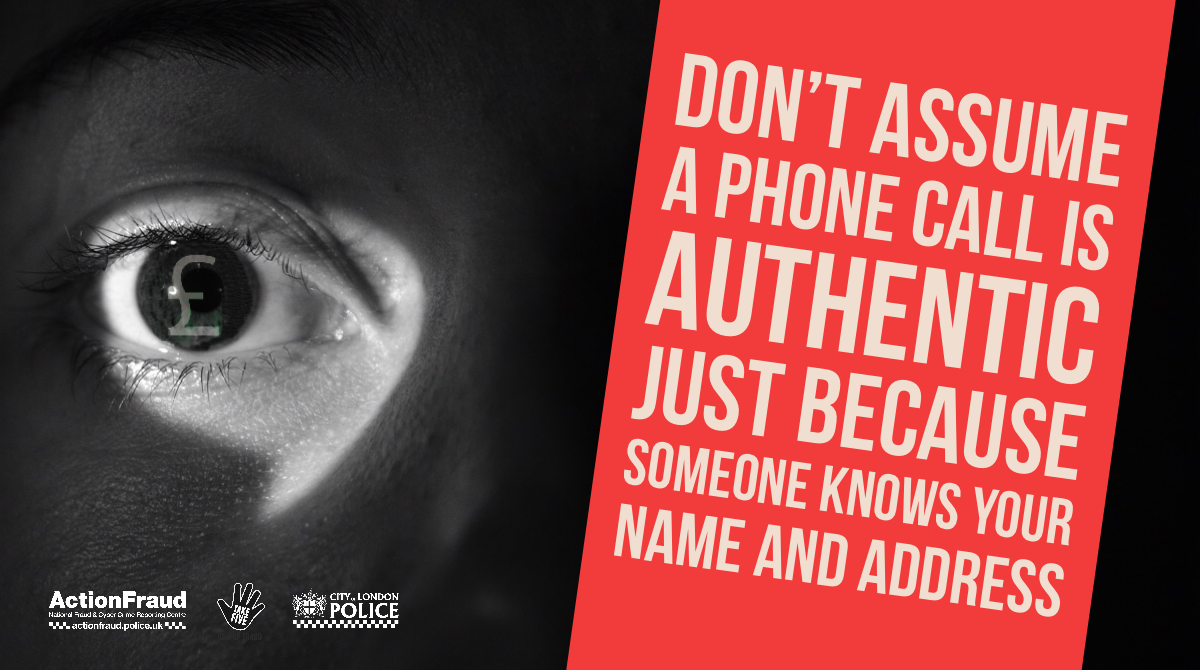

Courier fraud occurs when a fraudster contacts victims by telephone purporting to be a police officer or bank official. To substantiate this claim, the caller might be able to confirm some easily obtainable basic details about the victim such as their full name and address.

The caller may also offer a telephone number for the victim to telephone or ask the victim to call the number on the back of their bank card to check that they are genuine. In these circumstances, either the number offered will not be genuine or, where a genuine number is suggested, the fraudster will stay on the line and pass the victim to a different individual.

After some trust has been established, the fraudster will then, for example, suggest;

- Some money has been removed from a victim’s bank account and staff at their local bank branch are responsible.

- Suspects have already been arrested but the “police” need money for evidence.

- A business such as a jewellers or currency exchange is operating fraudulently and they require assistance to help secure evidence.

Victims are then asked to co-operate in an investigation by attending their bank and withdrawing money, withdrawing foreign currency from an exchange or purchasing an expensive item to hand over to a courier for examination who will also be a fraudster.

At the time of handover, unsuspecting victims are promised the money they’ve handed over or spent will be reimbursed but in reality there is no further contact and the money is never seen again.

Protect yourself

- Your bank or the police will never call you to ask you to verify your personal details or PIN by phone or offer to pick up your card by courier. Hang up if you get a call like this.

- If you need to call your bank back to check, wait five minutes; fraudsters may stay on the line after you hang up. Alternatively, use a different line altogether to call your bank.

- Your debit or credit card is yours – don’t let a stranger take it off you. You should only ever have to hand it over at your bank. If it’s cancelled, you should destroy it yourself.

Spot the signs

- Someone claiming to be from your bank or local police force calls you to tell you about fraudulent activity but is asking you for personal information or even your PIN to verify who you are.

- They’re offering you to call back so you can be sure they’re genuine, but when you try to return the call there’s no dial tone.

- They try to offer you peace of mind by having somebody pick up the card for you to save you the trouble of having to go to your bank or local police station.

How it happens

You may get called on your mobile or landline by someone who claims to be from your bank or the police. They say their systems have spotted a fraudulent payment on your card or it is due to expire and needs to be replaced.

They might suggest that you hang up and redial the number of their bank or police force to reassure you that they’re genuine. However, they don’t disconnect the call from the landline so that when you dial the real phone number, you’re still speaking to the same fraudster.

They’ll then ask you to read out your credit or debit card PIN or type it on your phone keypad. They may ask for details of other accounts you hold with the bank or elsewhere to grab more information.

Then they promise to send a courier to you to collect your bank card. The fraudster will have your name, address, full bank details, card and its PIN, and withdraw cash using the card and may even use the information to commit identity fraud in your name.

How to report it

Report it to us online or call 0300 123 2040.

If you’ve given your bank details over the phone or handed your card to a courier, call your bank straight away to cancel the card.