Up to 20,000 motorists could be driving uninsured after responding to cheap insurance offers advertised online or via small ads.

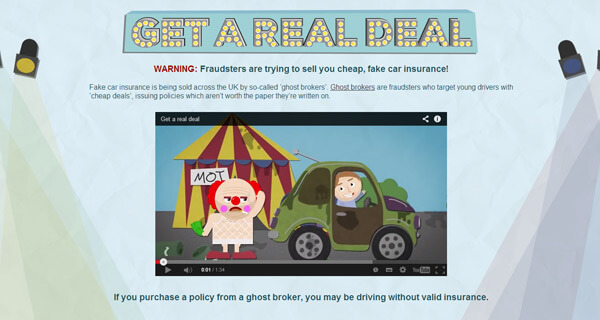

‘Ghost broking’ is seen as an emerging threat within the insurance fraud arena, with fraudsters targeting people who cannot afford to insure their car.

Importantly a new fraud unit within the police force has pledged to tackle this problem as part of a drive to combat insurance fraud, recently estimated to be costing the UK £3billion per year.

The Insurance Fraud Enforcement Department (IFED) will be funded by the insurance industry and run with operational independence by the City of London Police.

“Ghost brokers” profile their targets as motorists who are economising and looking for cheaper insurance deals. These motorists are likely to be young, living within communities where English is a second language and overall there is a lack of knowledge about insurance. Some of these drivers have purchased policies that are worthless.

Another scenario for carrying out the fraud involves ghost brokers applying to genuine insurance companies on behalf of the customer. In these cases personal details are changed to avoid pushing up the cost. Customers tend to live in areas where insurance premiums are particularly high. While some motorists may have agreed to some details being changed some are unaware that this has transpired until it’s too late.

Victim of Ghost Broking

One reported case is of 18-year-old female student from the Midlands, who was quoted £4,000 for insurance for a Ford Fiesta. Through her network of friends the woman was put in touch with an insurance company offering insurance at half the cost in return for a cash deposit of £700. It was a cheap deal because she would be taking advantage of a staff discount from an inside contact at the insurance company.

The woman thought better of handing over cash after a face to face meeting with the broker and trusted her instincts not to hand over any money but her friend who was also present convinced her that she could trust the broker. After parting with the £700 deposit, the woman provided her details believing that she was agreeing to further payments of £70 per month. A policy was e-mailed to her but she was surprised when more than the agreed amount was debited from her account.

In her words, “The payment came out of my bank but it was for more than the £70. I was scared to phone the insurance company in case they said: 'It's fraud and you are in trouble.'"

The person the woman had done business with had been a ghost broker who had falsely submitted her details as a 48-year-old driving instructor who had a five-year no-claims bonus. The 18-year-old had only been driving for a year.

Cheap Car Insurance Lure

Steve Gaywood, head of counter-fraud at AXA, said: "We all know car insurance premiums have risen in the last couple of years, and for some motorists it is difficult to afford or find.

“It seems that some unscrupulous individuals are using this as a hook to con people into buying insurance that isn't valid."

Det Supt Bob Wishart of the City of London Police said: "Ghost broking is an emerging threat within the insurance fraud arena, costing the industry millions of pounds, leaving companies exposed and meaning thousands of people are unknowingly uninsured.

“This new criminality is particularly prevalent in motor insurance, with fraudsters looking to capitalise on what is a compulsory and sometimes costly product.

"We will soon have a new police unit specifically to tackle insurance fraud. Ghost broking is a growing part of this problem and tackling it head-on will be a priority."

The Insurance Fraud Bureau offers advice to motorists shopping around for cheaper car insurance. The first step is to research any broker or company and make certain that are registered with the Financial Services Authority. In this way you can confirm that they are regulated.

Protect Yourself From Fake Insurance

The Bureau also offers tips to avoid being defrauded by an illegal insurance advisor. These are:

- Do not pay money to individuals you do not definitely know are legally providing insurance policies.

- Do not pay money into a personal bank account for an insurance premium.

- Ensure you understand what insurance cover is required and what you are purchasing.

- For peace of mind with your insurance, be safe, be sure. Check the FSA website or the ABI website.

If you or someone you know has paid money to an illegal insurance broker, report it to Action Fraud so that the incident can be passed on to the police.

Related links:

Insurance fraud

Insurance broker scams